The Income Tax Department of India now permits its PAN card applicants to apply for an e-PAN card instead of a physical PAN card. e-PAN works exactly in the same way as a physical PAN card and can be submitted for all types of financial transactions where it is mandatory to cite a PAN.

On May 28, 2020, Finance Minister, Nirmala Sitharaman, successfully launched an instant e-PAN facility that utilizes Aadhaar card-based e-KYC. e-PAN cards will be issued to applicants having a valid Aadhaar number and a valid mobile number linked to their Aadhaar.

The beta testing was launched earlier in February 2020 on the Income Tax Department’s e-filling website.

The turnaround time to get e-PAN card is only 10 minutes. On May 25, 2020, around 6,77,680 instant PAN cards were issued to the applicants.

There are different ways through which a candidate can apply for an e-PAN card. There are two ways to apply for an e-PAN card. But first, let’s go over what e-PAN cards are.

What is an e-PAN Card?

An e-PAN card, is a facility offered by the Income Tax department of India. The facility is instant and can be profited from by first-time tax payers. It is to be noted that an e-PAN card can’t be assigned to people who already have a physical PAN card. The following are the features of an e-PAN card:

- For a limited period, e-PAN can be acquired free of charge.

- e-PAN cards are issued to individuals only and not to HUFs, trusts, organizations, or businesses.

- The electronic PAN card is generated by using the details of the applicant’s Aadhaar card.

Who Can Apply for an e-PAN Card?

One should fulfill the following criteria for applying for an e-PAN card:

- The applicant must be an Indian resident.

- The applicant must be an individual taxpayer and not be an organization, trust, association, etc.

- The applicant must have a valid Aadhaar card.

- The applicant’s mobile number must be linked with the Aadhaar card.

- The applicant should not have a physical PAN card.

- An applicant must have an updated Aadhaar card.

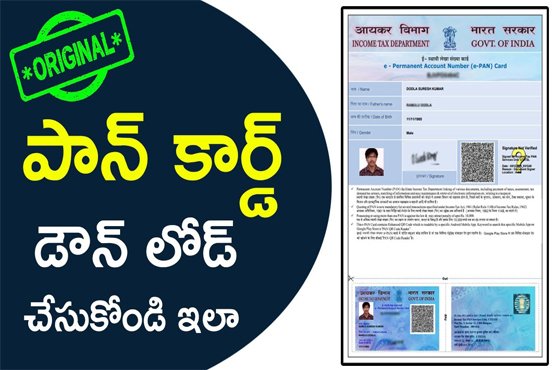

How does an e-PAN Card look?

An e-PAN Card reflects the following details:

- The Applicant name, date of birth, and other details

- QR code

- The applicant’s biometric details, like digital signature and scanned photo,

- Applicant’s father’s name

- Applicant’s gender

e-PAN can be downloaded through UTIITSL or NSDL as they are the two providers for issuing PAN cards.

How to Download an e-PAN Card from the UTIITSL Website?

An applicant can download an e-PAN Card through UTIITSL by following the steps given below.

- Visit the official website: https://www.pan.utiitsl.com/

- Select “Apply PAN Card” under the section “For PAN Cards”.

- To begin, click “Download e-PAN.”

- Complete the form by filling the details.

- An OTP will be sent either to your registered mobile number or an email id.

- Enter the OTP.

- On successful completion, an applicant will be given the option to download the e-PAN Card.

What are the steps for obtaining an e-PAN card through the NSDL Portal?

There are two ways to download an e-PAN card from NSDL—

1-Obtain an e-PAN Card using your Acknowledgement Number.

- Enter the acknowledgement number here.

- Enter your ‘birth date.’

- Enter the captcha code and click on the submit button.

- An OTP will be sent to the registered mobile number and email address.

- Enter the OTP and click download button to download the e-PAN Card.

- Download an e-PAN Card Using Your PAN Number.

- Enter the PAN and Aadhaar numbers.

- Provide the applicant’s date of birth.

- Add the GSTN number (if provided).

- Tick the guidelines checkbox and enter the captcha code.

- Click ‘Submit’ button and enter the OTP received on your registered mobile number or email.

- Obtain an e-PAN Card

*Note: It is mandatory to link Aadhaar with PAN before June 30th, 2021.

How to Download an e-PAN Card Using the Income Tax Department Website?

An e-PAN card can also be downloaded from the Income Tax Department of India website. An applicant needs to follow the following instructions:

- Login in to e-filing website of the Income Tax Department.

- Click on “Instant e-PAN” (given at the bottom of the screen).

- Click on ‘Get New e-PAN’.

- Enter your Aadhaar number and follow the instructions.

- Confirm all the given details and enter the OTP received on your registered mobile number or email.

- Obtain an e-PAN Card

I want to pan card

Please PAN card number

Pan card open

I loss my pan

card i have my pan namber I want my pan card download

Hi