What is POMIS?

The Post Office Monthly Income Scheme (POMIS) is a monthly scheme managed by the Department of Post (DOP). The Central Government of India manages this savings scheme. It provides a monthly income scheme for small and medium-sized individual investors, much like small savings schemes. This savings scheme is the best option for investors seeking additional pay and a lower-risk investment option. Since the interest rate and fixed income are predetermined and ensured, we can say that the POMIS saving scheme is a lower-risk investment option.

The provisions of the General Rules applicable to the Post Office Monthly Income Scheme are comparable to the issues for which no provision is available in this Scheme.

Features of a Post Office Monthly Income Scheme

- The POMIS investment scheme offers a month-to-month interest on the deposit amount. You can either withdraw at your own convenience or choose an automatic withdrawal and credit to your savings account.

- You can make payments to the POMIS account in amounts of Rs 1,000. Thus, in a way, the minimum amount is Rs 1,000.

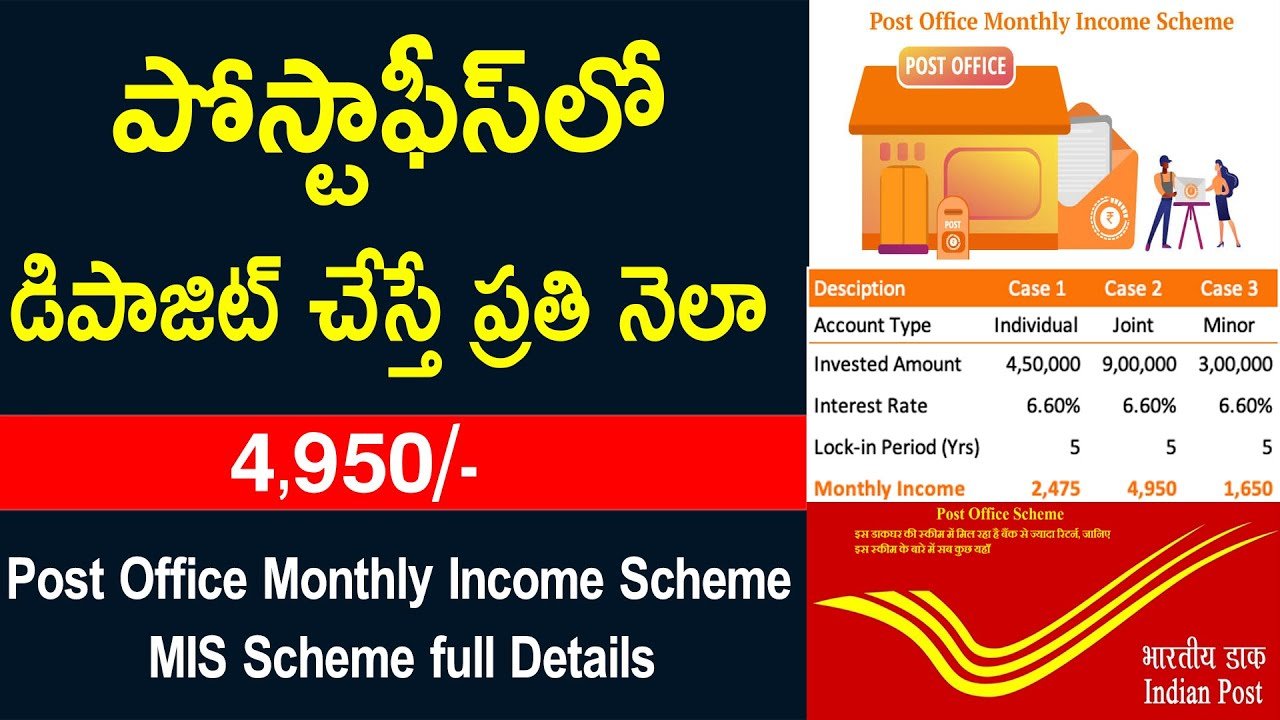

- A single account holder can deposit a maximum of Rs 4.5 lakh, while a joint account holder can deposit a maximum of Rs 9 lakh.

- An individual can invest a maximum of Rs 4.5 lakh in a single account or through a joint account.

- The interest amount on the POMIS investment scheme from 1st April 2020 is 6.6% per annum, payable monthly.

- The lock-in period is a long time of 5 years from the date of the account’s opening.

- You can withdraw after the expiry of one year. However, every premature withdrawal attracts a fee. A 2% fee is applicable if you withdraw before 3 years. Besides, the fee is simply 1% if you withdraw after 3 years.

- The provisions of the General Rules will, so far as might be, apply to the issues for which no provision has been made in this Scheme.

- No TDS is relevant to the interest income. In any case, neither the interest income nor the deposit amount qualifies for all requirements for any income tax deduction.

Eligibility for the Post Office Monthly Income Scheme

To open an account under the POMIS, one needs to submit an application on Form 1. Only listed individuals can apply for an account under the POMIS scheme.

- A single adult

- joint account with a max limit of up to 2 people.

- A minor who has attained the age of ten years is

- A guardian on behalf of a minor or an individual of unsound mind.

- An individual can open at least one single account or a joint account. However, the depositor should keep up with the maximum amount of deposit for all the accounts.

- The share of each account holder will be one and a half if there are two depositors. If there are multiple depositors, then the share will be 13 for every depositor in the joint account.

Deposits and Withdrawals under the POMIS Scheme

- The minimum amount required to open a POMIS account is Rs 1,000 or any multiple of Rs 1,000 rupees.

- A single deposit shall be made into an account.

- A max deposit of up to Rs 4.5 lakhs is the max for POMIS. For a joint account, the same is applicable up to Rs 9 lakh.

- A minor’s account and an account for a minor or an individual of unsound mind also have a max deposit limit of Rs 4.5 lakhs.

- If an individual holds more than one account, either jointly or exclusively, the limits continue as before. Deposits in all the accounts taken together for an individual will not surpass Rs 4.5 lakhs in a single account and Rs 9 lakhs in a joint account.

- If you deposit any amount above the maximum limit, the post office account officer will refund the excess amount.

How to open a POMIS account?

Opening a POMIS account isn’t as difficult as one thinks. It is really simple and hassle-free. One can open a POMIS account at any post office.

One needs to have a Post Office Savings Account before opening the POMIS account. If one already has a Post Office Savings Account, they can follow the below procedure to open a POMIS account.

Upon visiting the post office, one needs to collect and fill out the application and submit the following documents:

The following are the things that one needs to open a POMIS account:

- Two passport-size photos

- Address Proof

- Identity Proof (Aadhar Card, Voter ID, Pan Card, Ration Card, Driving License, Passport, and so on) The original copies of the proofs are required for verification.

The process of opening a POMIS account

- Visit the nearest post office.

- Get the application form and fill in the details.

- Provide the essential documents, complete the identity, and address proof of verification. The investor has to self-attest the documents.

- Enter the nominee’s details (if any). But, you can add the nominee details at a later point as well.

- Deposit the cash or cheque (a minimum of INR 1,500) and open the account. If the cheque is a post-dated cheque, the date of the account opening would be the date referenced on the cheque.

Please note that the interest disbursement on the investment amount is one month from the account opening date.

Moreover, one needs to get the signatures of a witness or a nominee (s) on the form.

Documents Required to Open a PO Bank Account

You need to submit the following documents to open another account and complete the KYC:

- Identity Proof: Aadhaar Card, PAN, Voter ID, Visa, Driving Permit. NREGA issued a work card that was endorsed by a State Government official.5. A Letter Given by the National Population Register Containing Subtleties of Name and Address

- Identity Card with Photograph issued by a recognized university/education board/college/school, Identity Card issued by the Central/State Government or PSU

- Address Proof-bank or post office passbook, visa, proportion card, service charges like power, phone, and so forth.

Interest on Deposit under the POMIS Scheme

- The deposit under the POMIS scheme offers a rate of interest of 6.60%.

- The monthly interest will be payable at the end of the month from the date of deposit.

- If you don’t claim or withdraw the monthly premium, it won’t earn any extra interest.

- Interest can be drawn through auto credit into savings accounts held at the same post office or ECS. On account of MIS records at CBS Post Offices, monthly interest can be credited into savings bank accounts remaining at any CBS Post Office.

- The interest income is taxable in the hand of the taxpayer under the head “Income from Other Sources.”

- The interest income earned will be adjusted to the closest rupee.

- The excess deposit amount shall carry interest at the rate applicable from time to time to the Post Office Savings Account. This will be paid to the depositor on such a sum.Such interest will be paid from the date of deposit of the excess amount till the month’s end, the month before the month wherein the deposit has been refunded.

- If the due date of payment of monthly interest, for example, the last day of the month, is a holiday or Sunday, then the payment will be made on the next business day.

Premature Withdrawal from the POMIS Scheme

- To make a premature withdrawal, you have to submit an application on Form-2 to the Post Office of India. You can either visit any nearby branch or apply online by signing into your account.

- Premature withdrawal or closure of an account is permitted only after one year from the date of account opening.

- If you close before the expiry of a long time from the date of opening the record, then a charge of 2% on the deposit sum will be applicable. You will get the leftover balance in the account.

- If you close the account after the expiry of a long time from the date of opening it, a charge of 1% on the deposit amount will be applicable. You will get the leftover balance in the account.

Closure of POMIS Deposit Account on Maturity

- You can undoubtedly close the account at any time after the expiry of 5 years from the date of opening the record.

- You need to present an application on Form-3 along with the passbook to the Post Office of India.

- If the account is closed, you will get the initial deposit amount along with the interest paid. The premium paid will be the amount accrued for the deposit period.

- If the account holder dies, the nominee or legal beneficiary will get the deposited amount and premium. The interest paid will be up to the month going before the month in which the discount is made.

The Advantages of Opening a POMIS Account

POMIS investment returns are not market-connected. The government backs it, henceforth offering ensured returns. For many conservative investors, the Post Office Monthly Income Scheme (POMIS) is a go-to option. The following are the two advantages of opening a POMIS account:

Steady Returns: Post Office Monthly Income Scheme POMIS offers fixed interest income. An investor earns a fixed and consistent progression of income consistently. The current loan cost is 6.60%. Along these lines, an investment made at this rate would earn a fixed monthly income.

Reinvestment: POMIS interest pay is a decent source of extra monthly income. One can gather the interest directly from the post office or transfer it to their bank account. The investor can choose to reinvest the monthly income.

Reinvesting as a SIP in either equity mutual funds or other mutual funds would help the cash grow. This reinvestment into shared assets is reasonable when the investor understands and is willing to undertake the risk. Also, a post office repeating store is one more choice that one can use to contribute their monthly interest. Upon maturity, one may also decide to reinvest the corpus in a similar scheme for an additional five years to get twofold advantages.